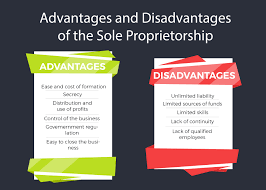

Compare the professionals and cons of a sole proprietorship to determine if that is the great entity kind to your small business.

Many or all of the goods shown right here belong to our partners who indemnify us. This can have an impact on what products we write about and wherein and the manner the product seems at the web page. However, this did now not have an impact on our assessment. Our thoughts are our personal. Here is a list of our companions and right right here is how we make cash.

Click here ofadvantages.com

Starting a small corporation can be an intimidating manner: You need to provide you with a commercial enterprise approach, solicit customers and manipulate brief- and lengthy-term budget. Plus, it could be even more frustrating to type thru the office work, office work, and registration steps to legally installation your commercial corporation. If you are nevertheless looking to determine which commercial corporation entity kind is high-quality for you, you’ll be interested in the advantages of a sole proprietorship.

While this form won’t be right for every commercial enterprise, there are numerous advantages to a sole proprietorship for masses entrepreneurs. This form of industrial organization entity is easy to installation, trustworthy and requires fewer procedural steps than exceptional entities consisting of organizations. In specific, one-individual corporations specially enjoy the blessings of a sole proprietorship, specially if their commercial corporation does no longer require a complicated felony or economic setup.

However, sole proprietorships have each benefits and disadvantages, so it is critical to be aware about at the same time as the blessings are outweighed via the use of their limitations, mainly in regards to non-public liability.

know more about these kinds of stuff here sole proprietorship advantages

Therefore, in this guide, we will damage down the blessings of a sole proprietorship (as well as the risks) so you have all of the information you want to decide whether or not or not this entity type is right to your organisation.

What Are The Benefits Of A Sole Proprietorship?

With this remark in mind, allow’s begin with the blessings of a sole proprietorship.

Five Benefits of Sole Proprietorship

Less workplace work to get started.

Easier strategies and fewer necessities for business taxes.

Low registration charge.

More direct banking.

Simplified business possession.

Ultimately, there is a motive most small groups within the United States check in as sole proprietorships: It’s easy, short, and easy. Most small companies do now not want to hassle with the requirements that include different business organization unit types. After all, if you run a one-individual warm dog stand, it will be a good sized challenge to form a board of administrators, and in case you’re a settlement creator you won’t benefit from forming a C employer—as it waives business agency and personal taxes. There might be no element in moving into one after the alternative.

Let’s Break Down Key Advantages Of Sole Proprietorship:

1. Less Office Work

The blessings of sole proprietorship are extensive and varied, in particular in case your corporation is small. However, one of the blessings first and essential is that you may not ought to do a ton of paperwork with this enterprise entity kind.

To provide an explanation for, special business enterprise structures, which includes restrained legal responsibility companies, require you to check in collectively together with your country authorities in advance than doing agency. On the alternative hand, with a sole proprietorship, you’re typically not required to sign on with the country; Instead, you come to be a enterprise entity by using the usage of different feature of doing enterprise only.

However, it’s far vital to be aware that you could need to gain a enterprise license or permit, depending at the necessities of your kingdom or close by government. Still, one of the preliminary blessings of a sole proprietorship is this shape permits you to broaden your business employer more quick, and with an awful lot less authorities office work within the stability.

2. Easy Tax Setup

One of the biggest blessings of a sole proprietorship is the pretty easy and simple tax necessities, mainly in comparison to other entity kinds.

First, whilst one-of-a-kind organization systems are required to apply for an enterprise identity quantity, or EIN, with the IRS, sole proprietors are not required to document for an EIN. With an EIN, these groups can accumulate and pay personnel smash away the filer’s Social Security range, but as a sole owner, you have got the choice of the usage of your Social Security quantity like you’ll for each different monetary transaction. Do what is required of it.

However, if you pick, you have the choice to apply for and use an EIN (there are a few benefits associated with doing so).

Additionally, in phrases of truly submitting taxes, a sole proprietorship has a few different first rate gain. Sole proprietorships are taxed as a bypass-via entity, because of this that organisation income and losses are mentioned in your character tax return. Hence, you do not want to fear approximately paying taxes one by one in your business enterprise; You can meet all of your wishes at the side of your personal annual 1040 form.

In addition, a few sole proprietors can be capable of take gain of the 20% tax deduction described in the Tax Cuts and Jobs Act of 2017, which permits you to deduct 20% of your commercial enterprise’s net income from your taxes.

3. Low Trading Fees

When You’re Starting a Business and InitiativesIf you’re strolling a bar, your finances can be tight. Therefore, one of the important blessings of a sole proprietorship is the capability to save on registration charges.

As we referred to above, states require LLCs and special company entities to join up with the united states in advance than doing commercial company. Most states additionally require LLCs to pay annual costs to hold their registration and those fees can upload up speedy. Fortunately, sole proprietorships do no longer have those equal legal requirements—meaning you may store on these charges (in addition to time and trouble) as compared to extraordinary business enterprise structures.

That being stated, till you want prison duty safety for your agency (more on that later), you can help hold extra cash for your financial institution account as a sole owner.

4. Direct Banking

One of the following extensive benefits of a sole proprietorship is simplified banking. A sole proprietorship is the simplest shape of business employer entity that doesn’t require a corporation bank account to carry out a agency. (You can theoretically run an LLC without a industrial employer checking account, however this invalidates the various personal finance protections that include proudly owning an LLC inside the first place.)

As a sole proprietorship, you may make and receive industrial company bills at once out of your private bank payments. You do not want to undergo the procedure of locating a employer checking account—although if you need to break up your personal and enterprise finances this manner, you do have the option of doing so.

Ultimately, in terms of banking, all you need is your non-public bank account to get commenced, make sure to hold organized and easy information to break up your employer and personal spending.